Here’s my A – Z list of some of the most common real estate terms you may encounter in the buying and selling process.

Acceptance

When a seller accepts a buyer’s offer according to its terms which usually leads to a binding agreement or contract.

Agent

A person given permission to act on behalf of a client in the sale, purchase, letting or management of real estate. Agents must be licensed from the relevant state agency.

Allotment

An area of land that is subdivided into smaller pieces.

Amenity

Is a feature of a neighbourhood. For example, a public swimming, school or park can be considered as amenities.

Amortisation period

The number of years it will take to fully pay off a home loan.

Appraisal

A free and comprehensive estimation of the value of your property by a real estate agent. The assessment compares your home’s features against recently sold and current on the market properties to determine its likely selling price in the current market.

Appreciation

The increase in the value of property over time.

Architrave

A moulding surrounding a door or window opening.

Asking price

The amount that a seller wants a buyer to pay to purchase the property.

Auction

A public sale in which property is offered for sale through a competitive bidding process.

Beam

A horizontal, load-bearing piece of timber or metal that has structural properties.

Bearer

A sub-floor timber or steel beam that supports floor joists.

Body corporate

A body of owners in a block of units. The council of the body corporate – elected by property owners in the block – meets at regular intervals to discuss various matters of administration, including repairs, maintenance and security.

Boundary

A line separating adjoining properties.

Breach of contract

Breaking the conditions of a contract.

Bridging finance

Finance that is obtained for a short period of time as a “bridge” to long-term finance. This funding may be required if a home purchase completes before the owner’s sale.

Building regulations

Rules which are designed to maintain public safety, health and minimum acceptable standards of construction.

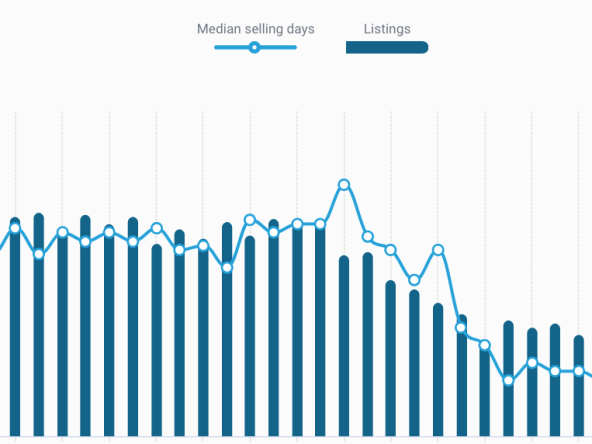

Buyer’s market

Market conditions where the supply of properties exceed the demand, giving buyers an advantage.

Capital growth

The increase in property value over time.

Capital Gains Tax (CGT)

The tax payable when a property is sold. This is based on the difference between the original purchase price and the sale price, including purchase and sale costs.

Capital Gains Tax discount

A discount of 50% on the CGT payable, provided the property has been owned for at least 12 months (and provided various other conditions have been met).

Caveat

Warns a person buying real estate that a third party has some right or interest in the property.

Caveat emptor

Latin for “buyer beware”. This principle of law requires that the buyer is satisfied with the property they wish to buy before completing the transaction. The buyer purchases the property on an “as is” basis.

Certificate of title

A document that confirms the ownership of land. It shows who owns it and whether there are any outstanding mortgages or loans against it.

Chattels

Property other than real estate that is included in a sale, including items of furniture.

Clear title

A title that isn’t encumbered with outstanding mortgages or loans.

Cluster housing

Detached group of houses that have a common open space.

Commission

A fee or payment made to a real estate agent on completion of the sale of a property.

Common area

A shared area that is available for use by more than one person, which might include the stairwell of an apartment block.

Common law title

Sometimes referred to as “old system title”, a common law title consists of a series of title documents referred to as “a chain of title”.

Compulsory acquisition (resumption):

The power of central or state governments to purchase property from without the owner agreeing to sell. A compulsory acquisition order could be used for the building of new transport links.

Contract of sale

A document that lists the terms and conditions of a property sale between the seller and the buyer.

Conveyance

The legal process of transferring the ownership of property from the seller’s name to the buyer’s.

Cooling off period

A period of time after the signing of a sale contract where the buyer can cancel the agreement. Cooling off periods however do not apply at auctions.

Covenant

A requirement noted on the title of a property that forces the property’s owner to adhere to named terms, conditions and restrictions regarding the property.

Cover note

A document issued by an insurance company to temporarily prove that a property has current insurance.

Deed

A legal document that is a record of an agreement, obligation or conveyance of property.

Depreciation

A reduction in the value of an asset over time.

Deposit

The sum of money normally paid by the buyer at the time of exchanging contracts. It is typically between 5 and 10 percent of the final purchase price.

Disbursements

Costs incurred by a real estate agent, which can be passed on to the client, for example photography and advertising costs.

Dual occupancy

An area of land or an existing dwelling that is zoned in such a way that allows the owner to construct a building that has two separate living arrangements.

Duplex

A residential property with 2 apartments – both of which have separate entrances.

Equity

The value an owner of a property has in the asset above the debt owed.

Exchange of contracts

The legal process that creates a binding agreement for the sale of a property. A deposit is usually paid at this time, and may be forfeited if either party backs out of the agreement.

Exclusive listing

When a vendor has signed an agreement to make an agent solely responsible for the sale of a property during a specified period. If another agent sells the property during that time, the original agent is entitled to any commission.

Expression of Interest (EOI)

When an agent asks buyers to register their interest on a home before a certain time.

Fittings

Goods or articles such as paintings and curtains that can be removed from a property without causing damage or an obvious reduction in its value.

Fixtures

Items such as baths, toilets and walk-in wardrobes that form part of the property and cannot be removed without causing damage.

Free standing

A property that stands independently of others.

Gazumping

The withdrawal from a verbally agreed sale by the vendor in favour of a quicker or more profitable sale. This practice is perfectly legal before contracts are exchanged and real estate agents usually act in the vendor’s best interest and take the higher offer. Any deposits are refundable but no compensation is owed.

Guarantor

A person who guarantees to pay a borrower’s debt in the event that the borrower defaults on loan obligations.

Home unit

A residential property grouped with others, having shared common areas and owned under a group title system. An apartment within a block of apartments may be referred to as a home unit.

Interest

The amount paid by a borrower to a lender in addition to the main amount borrowed (the “principal”). The interest rate can be fixed, variable or a combination of the two (“split loan”).

Interest only loans

The principal amount borrowed is not repaid until the end of the loan. Only interest is payable in the interim, but the owner will be expected to save through endowment or other property savings schemes.

Inventory

A list of items included with a property, including furniture and furnishings.

Investment

The purchase of an asset (like real estate) in order to produce capital gain.

Joint tenants

Joint tenancy is the holding of property in equal shares by two or more persons.

Land tax

A State government tax payable by owners of property based on the unimproved capital value of the property.

Lease

A lease is a legally binding contract or rental agreement between lessor (owner) and lessee (renter) where the lessee can occupy the lessor’s property for a set time in exchange for payment under certain terms. Also known as a tenancy agreement.

Lenders mortgage insurance (LMI)

Lenders mortgage insurance. Often payable when a borrower doesn’t have a big deposit, it’s designed to protect the lender against default.

Listing agreement

A contract between a property owner and a real estate agent that sets out the terms, conditions and commission associated with the sale of a specific property.

Loan to value ratio (LVR)

The value of the loan as a percentage of the value of the property.

Median price

The middle point of all the properties sold in a given time.

Mortgage

A legal document that gives a lender an interest over a property to secure the repayment of a loan.

Mortgagee

An entity that lends money on the security of a mortgage.

Mortgagor

An entity that borrows money offering the security of a mortgage.

Negative gearing

Where the rental return on an investment property is less than your interest repayments and outgoings.

Option to buy

A legal document giving a person a right to buy according to an option price and predetermined terms and conditions.

On the market

A term used during an auction when the vendor’s reserve price has been reached and the property is now officially for sale to the highest bidder.

Offset account

In a mortgage offset account or home loan offset account, the credit in the account is offset daily against the home loan balance, reducing the interest charged accordingly.

Off market

Property sold without public advertising.

Off the plan

To buy off the plan is signing a sale contract for a property that has not been built yet.

Pass in

When the vendor’s reserve price is not reached during auction, the property will ‘pass in’ and negotiations will continue privately. The previous highest bidder has the first opportunity to negotiate.

Positive cashflow

Income from the property (including tax benefits) is greater than all the expenses (including interest, rates and taxes, repairs, etc.).

Positive gearing

Where the rental return on an investment property is more than the interest repayments and outgoings.

Principal and interest loan

A loan whereby the lender repays a combination of interest and the principal borrowed throughout the term of the loan.

Private treaty sale

Sale of property through a real estate agent on the open market.

Progress payments

Funds paid by a loan provider in instalments to a builder – as the building work meets predetermined targets.

Property management

The management of a property on behalf of the owner.

Rates

The amount charged by the local council or water authority to provide services to a property.

Real property

Land with or without improvements on it.

Rental return

The annual rental income as a percentage of the value of the property (also called the rental yield or yield).

Reserve price

This is the minimum price a seller has specified that they will accept to sell their property at auction.

Seller’s market

Market conditions where the supply of property is low, giving sellers the advantage.

Semi-detached

Two houses joined together by a common wall.

Settlement

When the sale of a property is legally finalised.

Stamp duty

A government tax administered by individual states. It is calculated according to the sale value on the contract of sale. For mortgages, however, it is calculated on the amount to be advanced.

Strata title

A system of title that allows the owner of an apartment to have separate title for that specific unit of the building.

STCA

Subject to council approval, meaning the owner will need council approval before demolishing, renovating or building.

Subdivision

The process of dividing land into smaller allotments.

Survey

Shows the dimensions and boundaries of land and the exact location of buildings.

Tenancy

The right to occupy land or buildings as provided by the terms of a lease or other agreement.

Tenants in common

The holding of property by two or more owners.

Terrace

One of a row of houses joined together with common walls.

Torrens title

The name of the government system of recording ownership of land.

Town House

Two-storey attached dwellings usually registered under a strata title.

Transfer

A document registered at the Land Title Office recording the change of ownership to a property.

Trust account

A bank account managed by a real estate where funds (such as deposits and rental income) are held on behalf of someone else.

Unencumbered

Usually describes a property free of secured loans and mortgages.

Unconditional offer

An offer for property not subject to any other conditions (things like building and pest inspections or organising finance). The buyer accepts the property unconditionally. All auction sales are unconditional.

Under offer

When both parties have agreed on the purchase price and applicable terms and conditions, but the contract hasn’t yet been finalised, a property is ‘under offer’. Once the conditions have been met, the property is unconditional and then sold. Normally when a property is under offer no further offers can be made or accepted.

Vacancy Rate

The total number of vacant investment properties as a percentage of the total number of investment properties in an area.

Valuation

The definitive value of a property. It is based on recent comparable sales in the area. It is conducted by a qualified valuer for a fee.

Vendor (seller)

A legal property owner who offers the property for sale.

Vendor’s (seller’s) bid

A bid that is set by the auctioneer on behalf of the seller during an auction, to establish a fair starting price.

Villa

Single-storey dwelling usually registered under strata or community title.

Yield

The return that a property investor is likely to get on a property through rent. It is expressed as a percentage.

Zoning

Description of the allowable uses of land, as set out by local councils or planning authorities.